Forex Dual MACD Stochastic Trading System

Forex Dual MACD Stochastic Trading System:

System Overview

Markets Traded – Forex only, but mostly EURUSD and occasionally USDCHF,

GBPUSD, USDJPY, AUDUSD, GBPJPY

Charts – All time frames

Charting Software – MT4

Indicators – My custom KAY-Envelops indicator, Stochastic, MACD, Bollinger

Bands, Weekly Pivot, Fibonacci Retracements and Projections/Expansions,

Trendlines.

Chart Setup

The way I set up the chart, normally, I look at the bigger picture first. In this case,

I will open a higher time frame chart e.g. Daily and Weekly chart. This is good

enough to provide me a longer term direction of the market. If you prefer to trade

the weekly chart, the default higher timeframe is the Monthly chart.

I use the ONE HOUR chart as my trading chart and from time to time, I also look

at the 4 hour chart. Most of the time, I have 1 hour, 30 mins, 15 mins, 5 mins and

1 min chart open at the same time and viewable at one glance. This will help me

to see if the market is still going in the direction of my ONE HOUR chart and

often I exit some of the trade when the 5 or 15 mins chart is going against the

ONE HOUR chart. I sometimes use the lower time frame as my optimum trade

entry/exit area.

The setting of the charts are all the same as per set for the ONE HOUR as

shown below. For the chart, I normally use black color as the background and

white as the foreground. What you see here, is not my normal chart background

setting. This is only shown this way, in order to make it more readable as a

document.

Once you have set up a chart with the relevant indicators, you can then save it as

a template and just simply load the template for other timeframe.

List of indicators used in this strategy are shown below:

Open a 1 Hour chart and then add the following indicators to your chart:

KAY_Envelops (55, 5, 20)

KAY_Supp_Resist_Weekly (10080, 5,35)

Bollinger Bands (20,2, 0)

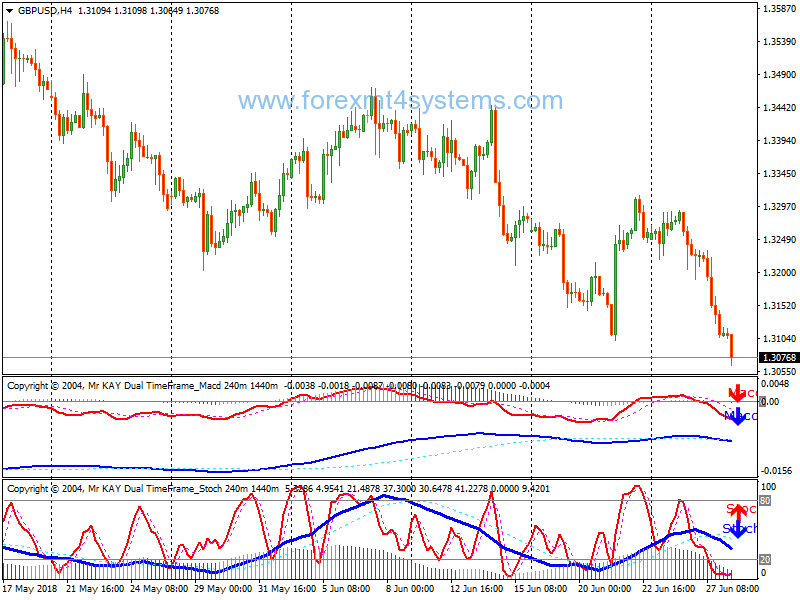

KAY_DualTimeFrameMACD (12,26,9,12)

KAY_DualTimeFrameStoch (8,3,3)

The settings used for each indicator are shown below. It’s fairly self explanatory

but I’ve also listed the settings below each image for your convenience.

System Rules

The generic system rules are as follows:

Short Trades

1. Open a higher time frame chart to provide us the longer term picture of the

market direction i.e. if you are trading the 1 hour chart open the 4 hour

chart at least. Alternatively open the Daily and/or Weekly chart if you

prefer.

2. Use the ONE HOUR chart to examine where the market is in relation to

the KAY Envelops and Weekly Support/Resistance lines.

3. If price hits both of the outermost lines as well as the Weekly

Support/Resistance lines, wait for the market reaction by observing the

Bollinger Bands contraction.

4. If during/after Bollinger Bands contraction, the market is below the Weekly

Support/Resistance, then there is an opportunity is to go SHORT (SELL).

5. Check the KAY Dual TimeFrame MACD if the direction is in agreement, if

it is then standby to enter the market when the KAY Dual TimeFrame

Stochastic is also in agreement with the MACD indicator.

6. If all above are aligned, then use the ONE HOUR Stochastic for entry.

Alternatively, you can also use the lower time frame to time your optimum

trade entry. Normally I open four SELL orders with four different target

levels. My target levels are as follows:

Sell Order 1 Target at the 61.8 Fibonacci Expansion level.

Sell Order 2 Target at the 100.0 Fibonacci Expansion level.

Sell Order 3 Target at the 161.8 Fibonacci Expansion level.

Sell Order 4 Target at the next Resistance line (point 9).

7. Draw a Fibonacci Expansion to determine the 61.8, 100.0 and 1.618

Expansion levels that we will use for our targets.

8. For my exit strategy I normally move my stop loss up as new bars are

formed. If I am SHORT, then I use the highest high of the bars within the

price range as my Stop Loss. You can also use both the outermost KAY

Envelops and Weekly Support/Resistance lines as your STOP LOSS.

9. Set the ultimate profit target on the next higher Weekly

Support/Resistance for SHORT positions.

10. There are a number of different partial trade exits I use. They are (in any

order of preference):

a. ONE HOUR stochastic reverse signal.

b. Break of Trendline.

c. Fibonacci projection levels @ 0.618, 1.00 and 1.618.

d. Stochastic histogram reverse signal.

e. MACD histogram reverse signal.

f. Lower than ONE HOUR timeframe reverse signal especially if the

MACD are all against the trade.

g. Hitting the opposite side of the Most Outer Envelops lines (Or Most

inner for higher time frame or for an early win).

h. Hitting a trailing Stop when Pivot line is hit, based upon the three

previous bars lowest low for LONG trades.

Long Trades

1. Open a higher time frame chart to provide us the longer term picture of the

market direction i.e. if you are trading the 1 hour chart open the 4 hour

chart at least. Alternatively open the Daily and/or Weekly chart if you

prefer.

2. Use the ONE HOUR chart to examine where the market is in relation to

the KAY Envelops and Weekly Support/Resistance lines.

3. If price hits both of the outermost lines as well as the Weekly

Support/Resistance lines, wait for the market reaction by observing the

Bollinger Bands contraction.

4. If during/after Bollinger Bands contraction, the market is above the Weekly

Support/Resistance, then there is an opportunity is to go LONG (BUY).

5. Check the KAY Dual TimeFrame MACD if the direction is in agreement, if

it is then standby to enter the market when the KAY Dual TimeFrame

Stochastic is also in agreement with the MACD indicator.

6. If all above are aligned, then use the ONE HOUR Stochastic for entry.

Alternatively, you can also use the lower time frame to time your optimum

trade entry. Normally I open four BUY orders with four different target

levels. My target levels are as follows:

Buy Order 1 Target at the 61.8 Fibonacci Expansion level.

Buy Order 2 Target at the 100.0 Fibonacci Expansion level.

Buy Order 3 Target at the 161.8 Fibonacci Expansion level.

Buy Order 4 Target at the next Resistance line (point 9).

7. Draw a Fibonacci Expansion to determine the 61.8, 100.0 and 1.618

Expansion levels that we will use for our targets.

8. For my exit strategy I normally move my stop loss up as new bars are

formed. If I am LONG, then I use the lowest low of the bars within the

price range as my Stop Loss. You can also use both the outermost KAY

Envelops and Weekly Support/Resistance lines as your STOP LOSS.

9. Set the ultimate profit target on the next higher Weekly

Support/Resistance for LONG positions.

10. There are a number of different partial trade exits I use. They are (in any

order of preference):

a. ONE HOUR stochastic reverse signal.

b. Break of Trendline.

c. Fibonacci projection levels @ 0.618, 1.00 and 1.618.

d. Stochastic histogram reverse signal.

e. MACD histogram reverse signal.

f. Lower than ONE HOUR timeframe reverse signal especially if the

MACD are all against the trade.

g. Hitting the opposite side of the Most Outer Envelops lines (Or Most

inner for higher time frame or for an early win).

h. Hitting a trailing Stop when Pivot line is hit, based upon the three

previous bars lowest low for LONG trades.

[ NOTE: The Pivot line is generally a place for the market to rest before

continuing the journey in the same trend as previous move, though sometime it

reverses the direction]

On exit strategy, the very first two things to do are to set the initial STOPLOSS

[1] and the ULTIMATE PROFIT TARGET [2].

If you are LONG, then use the lowest low of the bars as your STOP

LOSS[1] and set your ULTIMATE PROFIT TARGET [2] at the next higher

In forex a trading strategy is a fixed plan that is designed to achieve a profitable return by going long or short in markets. The main reasons that a properly researched trading strategy helps are its verifiability, quantifiability, consistency, and objectivity.

For every trading strategy one needs to define assets to trade, entry/exit points and money management rules.

How to install Forex Dual MACD Stochastic Trading System?

- Download Forex Dual MACD Stochastic Trading System.zip

- Copy mq4 and ex4 files to your Metatrader Directory / experts / indicators /

- Copy tpl file (Template) to your Metatrader Directory / templates /

- Start or restart your Metatrader Client

- Select Chart and Timeframe where you want to test your forex strategy

- Load indicator on your chart

How to uninstall Forex Dual MACD Stochastic Trading System?

To shut down an indicator, one has to remove it from the chart. At that, its drawing and recalculation of its values will stop. To remove an indicator from the chart, one has to execute its context menu commands of “Delete Indicator” or “Delete Indicator Window”, or the chart context menu command of “Indicators List – Delete”.