Forex XPS v8 Synergy Trading Strategy

Forex XPS v8 Synergy Trading Strategy;

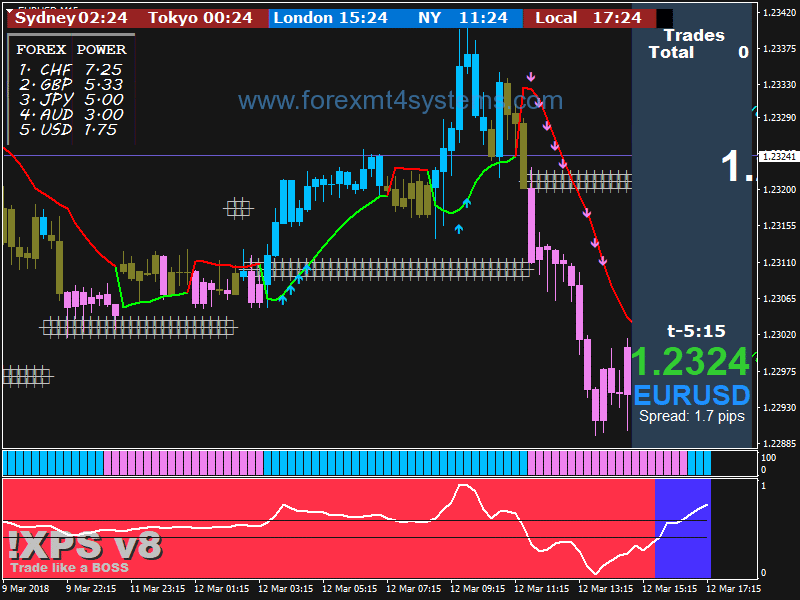

BOSS MODE is a trend catching setup, meaning it was designed and built to get you in and out of the trend.

The reason for this is because most pips are made while catching the trend.Inside the Oscillator window you will see the Range indicator.

This is real easy to read…

White line above top black line…. price going up

White line below bot black line…. price going down

Now, this indicator will show the start of a new move when the white line crosses the black

line especially if the Oscillator has just changed as well.

The drawback to using this indy is even though it is great at showing us when to get in onthe start of a new move, it is much harder to see continuation moves with this indy.

Not to worry. The histo indy that is in the window above the Oscillator is a filter indy 🙂 This will work hand hand with the range indy to show us continuations in the current trend as well as an exit strategy if you are not already out of the move, if the filter goes against you then it is time to exit.Also the filter indy will help you decide if its a good time to get in.

As a rule of thumb… do not trade against the filter indy… it is there for your

protection.

The higher gann ssl which will show you 4hr on 1hr & 30m chart and daily on 4hr chart.

This way you can see the immediate higher timeframe as it is critical to your decision

making process.

Trading with the higher time frames is preferred.

The smaller Gann ssl is part of your trigger. You want to be in a red smaller gann ssl tolook to sell, and in a green smaller gann ssl to look for a buy.

You want to be in a red small gann ssl with in a yello big gann ssl to sell, and in a green sslwith in a purple big gann ssl to buy.

The DSR in the main chart that looks like a squared cross hair or hash mark, think of itas a zero line, you want to be above it when going long and you want to be below it when

going short. It is there as a confidence booster. Just watch it for a few days and you will see why.

Just remember the Range indicator is very important. You shouldn’t take the trade

unless you have the Range white line crossing the Top black line for a buy trade and

cross the Bottom black line for a sell entry.I want the Range line to be facing up or down

when it does it’s cross.

A Flat Range line is a weak signal.

Use the Trend signal Arrows to confirms your entry decision. At least until you get the

hang of this setup.

When you get a Trend Sig Arrow, make sure you got Trend bars across the the DSR (

the grey hashmarks), or at least the mid line of the hashmarks before you take your

entry.

DSR. Stands for Dynamic Support & Resistance. It’s support and resistance that

adjusts to price while price moves. So you want to break past S & R before taking a

entry on a trade. You might even want to wait for price to retest the S & R that you just

broke thru before you enter a trade.

What I mean is say your getting trend signal arrows on each candle and every candle

afterwards, but then on the next candle you don’t.

The streak of trend arrows has stopped so this means the trend may have slowed down

or even stoped. So this is something to keep in mind.

Another that you want to pay attention to is the Murrey Math. There a many ways to use

murrey math, and if someone has some ideas on how else to use it here to beter trading

this setup, please let me know.

But as for me, I try to keep it as simple as possible.So what I look is how much price has moved across the murrey math map.

I do this to get an idea to when it may be running out of gas and when it may want to

start going in the other direction.

So say price trends downwards for a while and then it comes into the oversold areas of

Murrey math. The 1/8 and -1/8 area and beyond. Now I’m looking for signs of weakness.

Like a double or triple bottom.

Now that I’m in the over sold area of the murrey math. I’m not looking to take anymore

sell trades.

I’m now looking for the trend to change and go upwards

On Take Profit It will be different for each time frame. I will set a predetermined

number of pips that I want to take profit at. For the 1hr eur/usd for example I would

strive for around 60 pips.

I always open 2 trades on a pair at a time, this way I can try and make the second trade

run.

So I open 2 trades on the eur/usd and set the first trade to take profit at 60 pips or

the nearest monthly pivot, s/r. Once I have taken this first take profit on the first

trade I let the second run until the candles change color against me.

The how point of this is to bag my first trade early to give me leeway to let the second

run.

This is just my style of trading, you should do what works for you.

When it comes to StopLoss. I first set an initial stop loss of 80-100 pips to avoid my

account from being wiped out from some freakish news.

Once I take the trade off the DSR in the direction I want to go, and the trade has

moved my way a little I then move my stoploss to just above or below the last small gann

line entry.

The whole point of me doing this is that I want to get out if the trade goes against me.

When price goes against you and it hits the last high or low of the last small gann line

then the gannline changes and price can be going against you. Keep in mind that when a

trade first begins that it can go up and down until it goes the way it is going to go that

‘s why I wait until the trade goes my way a little before moving stoploss close to small

gannline.

Again this is just the way I do it, so you should do how ever you feel confortable

trading.

In forex a trading strategy is a fixed plan that is designed to achieve a profitable return by going long or short in markets. The main reasons that a properly researched trading strategy helps are its verifiability, quantifiability, consistency, and objectivity.

For every trading strategy one needs to define assets to trade, entry/exit points and money management rules.

How to install Forex XPS v8 Synergy Trading Strategy?

- Download Forex XPS v8 Synergy Trading Strategy.zip

- Copy mq4 and ex4 files to your Metatrader Directory / experts / indicators /

- Copy tpl file (Template) to your Metatrader Directory / templates /

- Start or restart your Metatrader Client

- Select Chart and Timeframe where you want to test your forex strategy

- Load indicator on your chart

How to uninstall Forex XPS v8 Synergy Trading Strategy?

To shut down an indicator, one has to remove it from the chart. At that, its drawing and recalculation of its values will stop. To remove an indicator from the chart, one has to execute its context menu commands of “Delete Indicator” or “Delete Indicator Window”, or the chart context menu command of “Indicators List – Delete”.