Forex Hammer Candlestick Trading Strategy

Forex Hammer Candlestick Trading Strategy:

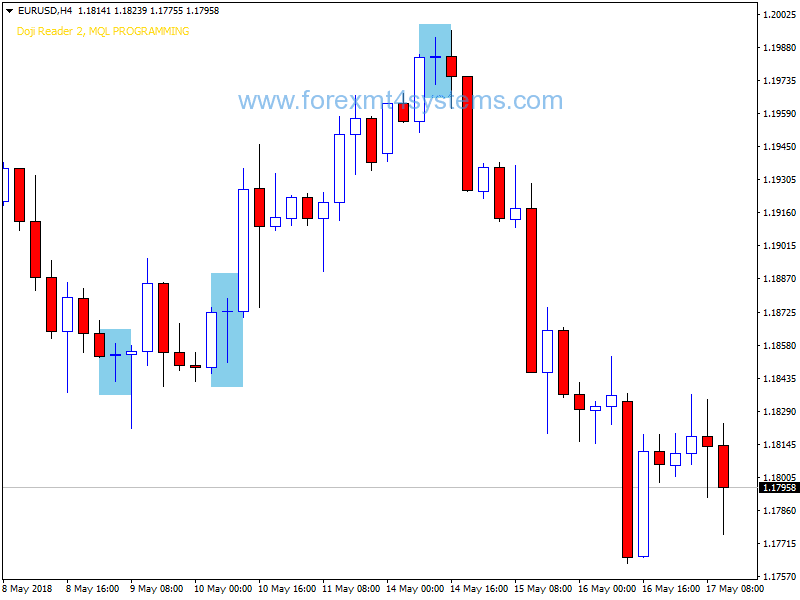

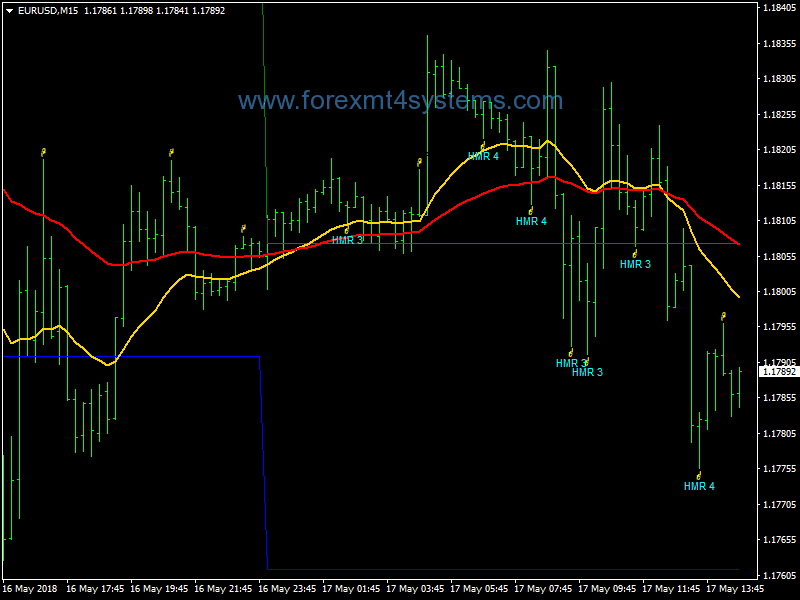

This system is used on 15-minute and 4-hour timeframe. With 15-minute

timeframe, daily pivot points are employed. Weekly pivot points are utilized when

trading off 4-hour timeframe.

In this manual, I’ll present the entry signals for swing trading off 4-hour

timeframe. We use the same techniques to generate entry signals

on 15-minute timeframe but using daily pivots instead of weekly pivots.

Okay, let’s dive right in the meat of Pivot Candle Trading System:

Buy Entry Signals: Three criteria must be fulfilled:

a. Price must be above 20-period Exponential Moving Average (EMA20) and

EMA20 must be above 50-period Exponential Moving Average (EMA50).

b. Price moved past a pivot level (S1/S2/S3/P/R1/R2/R3) and retraced back

on the exponentials moving averages (Time Frame 15 min 4H Time Frame retrace back also Weekly pivot points level).

c. A hammer formed.

When the hammer candlestick closed, we enter at market price with three lots.

Stop loss should be placed 10-20 pips below the Low of the hammer depending

on the volatility of the currency pairs we’re trading.

Exit Signals:

a. When price moves in our favor the same distance as our stop loss we take

one lot out. For example, if our stop loss is 50 pips away from entry price,

when we have 50 pips in profit we exit one lot.

b. For the remaining two lots, we trail our stop loss a few pips (5-10 pips)

below EMA20. We let our profits run and let the market decide when our

positions are closed.

For sell (short) entry and exit signals, the rules are obviously the opposite of

the rules for buy (long) signals.

In forex a trading strategy is a fixed plan that is designed to achieve a profitable return by going long or short in markets. The main reasons that a properly researched trading strategy helps are its verifiability, quantifiability, consistency, and objectivity.

For every trading strategy one needs to define assets to trade, entry/exit points and money management rules.

How to install Forex Hammer Candlestick Trading Strategy?

- Download Forex Hammer Candlestick Trading Strategy.zip

- Copy mq4 and ex4 files to your Metatrader Directory / experts / indicators /

- Copy tpl file (Template) to your Metatrader Directory / templates /

- Start or restart your Metatrader Client

- Select Chart and Timeframe where you want to test your forex strategy

- Load indicator on your chart

How to uninstall Forex Hammer Candlestick Trading Strategy?

To shut down an indicator, one has to remove it from the chart. At that, its drawing and recalculation of its values will stop. To remove an indicator from the chart, one has to execute its context menu commands of “Delete Indicator” or “Delete Indicator Window”, or the chart context menu command of “Indicators List – Delete”.