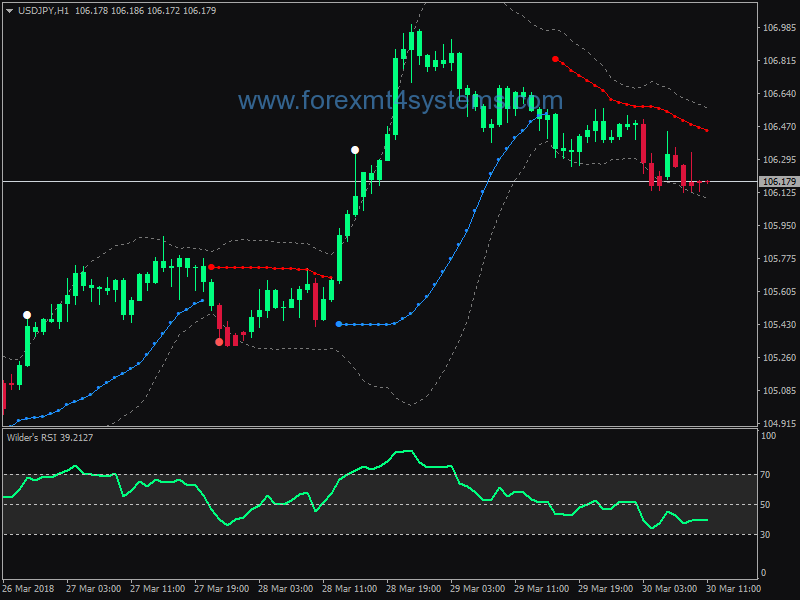

Forex Swing Spike Bollinger Bands Trading Strategy

Forex Swing Spike Bollinger Bands Trading Strategy:

Time Frame 4H or daily (best time frame daily).

Financial Markets: any

1. A 200 period simple moving average (SMA) ,

-

A 100 period SMA ,

3.A 50 period SMA (Based on close),

-

A 100 period Bollinger Bands (100, 2))

-

200 period bolliger bands (200, 2)

-

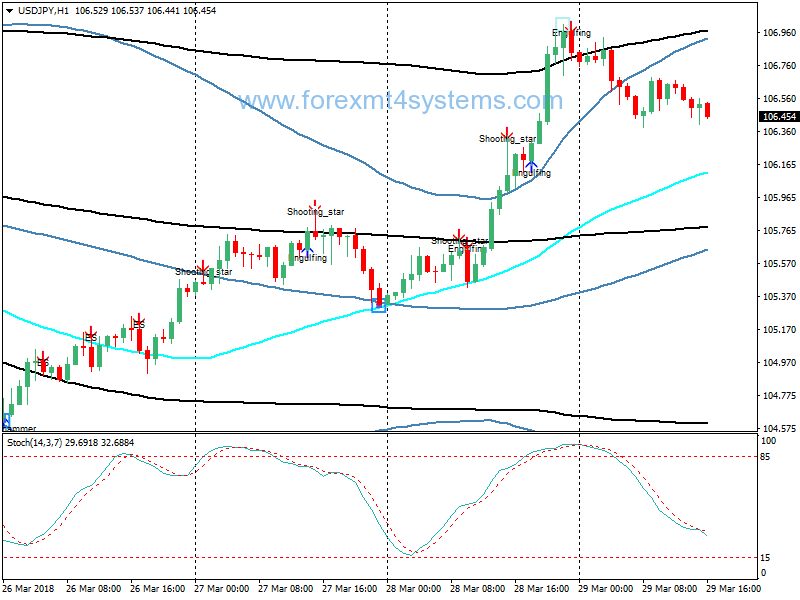

CPI, (set only candlestick reversal patterns),

-

Spike pattern (candlestick pattern).

Rules for: Bollinger Bands Forex Swing Trading

the price must be at or near either the 50 SMA, 100 SMA, 200 SMA, 100BB or 200BB. At any other place on the chart, trading is not allowed. These indicators act as zones/levels or probability and they mean that the chance of a

reaction has increased considerably.

Important: in the case of the BB’s only – the price can sometimes

travel a fair distance through the BB. No matter how far through it has

gone, a trade may still be considered.

Trade entries may only be considered if/when the 14/7/3

stochastic is overbought (both lines above 80 on the stochastic chart)

or oversold (both lines below 20 on the stochastic chart). Further, the

stochastic lines must be “turning and touching”.

There must be a clear reversal candle (or bar) on the chart

which occurs at one of the zones of probability and when the

stochastic is “touching and turning” I have highlighted some of the

common candle patterns in the pages above, and the most

important patterns are “spikes” such as dojis, engulfing candles, piercing patterns.

Buy

-

Stochastic Indicator is in Oversold and crosses downward ;

-

The price where the price is touching or very close to the above 50,100 or 200 SMA OR the 100 or 200 BB.

-

Wait the formation reversal pattern.

Sell

-

Stochastic Indicator is in Overbougth and crosses upward ;

-

The price where the price is touching or very close to the below 50,100 or 200 SMA OR the 100 or 200 BB.

-

Wait the formation reversal pattern.

Exit position

4H chart: profit target 80-100 pips depends by currency pair and Initial stop loss 50-70 pips. After 60 pips in gain move stop loss at the entry price and insert a trailing stop of 30 pips.

Daily chart: profit target 250-300 pips. Initial stop loss 80-130 pips after 150 pips in gain move stop loss at the entry price and insert an trailing stop of 50 pips

In forex a trading strategy is a fixed plan that is designed to achieve a profitable return by going long or short in markets. The main reasons that a properly researched trading strategy helps are its verifiability, quantifiability, consistency, and objectivity.

For every trading strategy one needs to define assets to trade, entry/exit points and money management rules.

How to install Forex Swing Spike Bollinger Bands Trading Strategy?

- Download Forex Swing Spike Bollinger Bands Trading Strategy.zip

- Copy mq4 and ex4 files to your Metatrader Directory / experts / indicators /

- Copy tpl file (Template) to your Metatrader Directory / templates /

- Start or restart your Metatrader Client

- Select Chart and Timeframe where you want to test your forex strategy

- Load indicator on your chart

How to uninstall Forex Swing Spike Bollinger Bands Trading Strategy?

To shut down an indicator, one has to remove it from the chart. At that, its drawing and recalculation of its values will stop. To remove an indicator from the chart, one has to execute its context menu commands of “Delete Indicator” or “Delete Indicator Window”, or the chart context menu command of “Indicators List – Delete”.