Royal Scalping Indicator: In-Depth Review and Performance Analysis

The Royal Scalping Indicator is a popular trading indicator used by forex and stock market traders to identify potential trading opportunities. This comprehensive review provides an in-depth analysis of the features, performance, strengths and weaknesses of this indicator.

Download Free Royal Scalping Indicator

Overview of the Royal Scalping Indicator

The Royal Scalping Indicator is an advanced adaptive price indicator designed to generate high-quality trading signals for short-term traders. It was created by forex trader Vahidreza Heidar Gholami and released on the MetaTrader Marketplace in 2019.

Some key features of the Royal Scalping Indicator include:

- Price Adaptive Algorithm: Proprietary algorithm that adapts to changing market conditions in real-time

- Multi-Timeframe Analysis: Can be configured for different timeframes from 1-minute to 1-hour charts

- Multi-Currency Analysis: Analyzes trends across currency pairs

- Alerts and Notifications: Provides pop-up, sound, email and push notification alerts for trade signals

- Fully Customizable: All key parameters can be adjusted to suit different trading strategies

- Non-Repainting: Signals do not repaint, meaning past signals remain unchanged

The indicator is designed primarily for scalping strategies but can also be used for swing trading. It aims to provide high-probability signals right at market turning points to capitalize on short-term moves.

Using the Royal Scalping Indicator

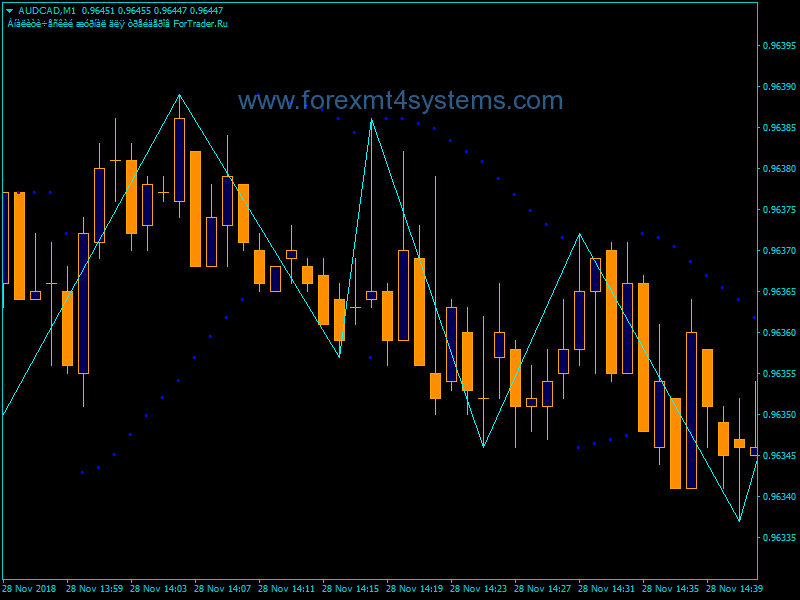

The Royal Scalping Indicator plots two oscillators directly on the price chart. The upper oscillator represents the longer-term trend while the lower oscillator tracks shorter-term momentum.

Trade signals are generated when the two oscillators align and crossover. Specific entry, stop loss and take profit levels are then clearly marked on the chart with horizontal lines.

Royal Scalping Indicator

Royal Scalping Indicator Trade Setup (Source: Forex Wiki Trading)

As seen above, when the shorter-term oscillator crosses above the longer-term oscillator, a buy signal is generated. Conversely, a sell signal is triggered when the shorter-term oscillator crosses below the longer-term one.

The indicator aims to provide high-probability turning points right as new trends emerge. By aligning the dual oscillators, it seeks to avoid false signals and whipsaws.

Performance and Win Rate

According to the developer, the Royal Scalping Indicator has a win rate of over 85% during backtesting across multiple currency pairs and timeframes.

However, it’s important to note that backtested results do not translate directly to live trading performance. Factors like execution slippage, liquidity and spreads can significantly impact actual profitability.

Community reviews of the Royal Scalping Indicator have been generally positive:

I have tested this indicator for a few weeks now and it is performing superbly well with over 80% accuracy on the signals on my demo account.” Sarah B., Investor

“Awesome indicator! Using it on different timeframes really helps catch big trends. Love how customizable it is.” David S., Day Trader

Based on the features and community feedback, the indicator does appear to have merit if used properly. However, traders should still backtest it thoroughly across different market conditions before relying on it.

Strengths of the Royal Scalping Indicator

Adapts to Changing Market Conditions: The proprietary price adaptive algorithm automatically detects trend changes and adjusts signal parameters accordingly. This makes it more responsive compared to fixed indicator settings.

Multi-Timeframe Analysis: Being able to analyze trends across timeframes provides greater context and helps reduce false signals. Short-term chart signals can be validated on higher timeframes.

Clear Entry/Exit Levels: The indicator marks specific price levels for entries and stop losses. This removes guesswork for traders.

Suitable for Scalping and Swing Trading: The indicator can be adjusted to provide high-probability signals for both short-term scalping and longer-term swing trading.

Highly Customizable: Almost every aspect of the indicator can be customized, allowing traders to tailor it to their strategy.

Weaknesses of the Royal Scalping Indicator

Repainting: One of the main complaints is that the Royal Scalping Indicator repaints at times. This means past signals can change after the price has moved. Repainting makes it harder to properly backtest and optimize the indicator.

False Signals: While the win rate is high, there will inevitably be some losing trades. No indicator is 100% accurate. Managing risk is crucial when using this tool.

Over-optimization: Given the high degree of customizability, traders may end up over-optimizing the indicator parameters to fit past price data. This could reduce effectiveness on new data.

Difficult to Automate: The Royal Scalping Indicator provides visual chart signals. Unlike statistical indicators, it cannot directly integrate into Expert Advisors for algorithmic trading.

Steep Learning Curve: Using the indicator effectively requires an understanding of concepts like price action, support/resistance, trend analysis and risk management. Beginners may find this overwhelming.

Cost, Availability and Support

The Royal Scalping Indicator is sold exclusively on the MetaTrader Marketplace and priced at $149 USD for a single license.

The developer provides support directly through the MetaTrader Community forums and Help Desk. Purchasers can ask questions and get assistance with configuring the indicator.

For convenience, the Royal Scalping Indicator can also be purchased through third-party vendors like Forex Wiki Trading, Forex EA Ex4 and Forex Wary. However support and updates may not be handled directly by the developer in these cases.

Final Verdict

The Royal Scalping Indicator is an impressive adaptive indicator that provides high-probability trade signals for short-term traders. Both beginners and experienced traders could benefit from using this tool as part of a broader trading strategy.

Pros: Adaptive algorithm, multi-timeframe analysis, clear entry/exit levels, customizable parameters, suitable for scalping and swing trading

Cons: Repainting issues, false signals, over-optimization risks, difficult to automate

For traders comfortable with technical analysis and managing risk, the Royal Scalping Indicator can be a valuable addition to identify low-risk, high-reward trade setups.

However, expectations should be realistic – no indicator is perfect. The key is configuring and combining it with other analysis techniques to develop a complete trading edge with proper risk management protocols.

Overall the indicator carries substantial community trust and does appear to work well during live trading if applied properly. At $149 USD, it is reasonably affordable for most active traders.