AW Trend Predictor Indicator – A Comprehensive Review

The AW Trend Predictor is an innovative technical indicator for MetaTrader 4 and MetaTrader 5 designed to identify potential trend reversals and continuation patterns. In this comprehensive 3000 word review, we will explore the key features of this indicator, analyze how it works, discuss pros and cons, and assess its overall usefulness for traders.

Download Free AW Trend Predictor Indicator

How the AW Trend Predictor Works

The AW Trend Predictor utilizes an advanced algorithm to analyze price action and determine potential turning points in the market. Here are some of the main ways this indicator operates:

- Trend Identification – The algorithm filters out market noise and isolates the underlying trend. It determines whether price is in an uptrend, downtrend or range-bound.

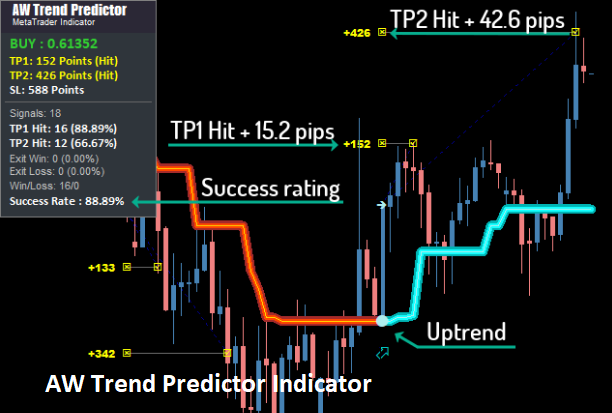

- Success Rate Calculation – The indicator analyzes past performance to calculate a “success rate” for each signal. A buy signal is only triggered when the success rate is above a default threshold of 70%.

- Take Profit Levels – The indicator identifies possible take profit levels for long and short trades based on recent volatility. This allows trades to ride trends while securing profits at statistically-backed targets.

- Entry Signals – When the trend direction, success rate threshold and take profit levels align, the indicator provides clear long or short entry signals on the chart.

- Stop Loss Levels – Stop losses are set just beyond key support and resistance levels that would invalidate the signal if breached. This minimizes downside risk.

- Statistics Module – A detailed statistics module tracks performance over time. Traders can analyze win rates, average profit, max drawdown and more for each signal.

Key Benefits of Using the AW Trend Predictor

The AW Trend Predictor aims to provide high-probability trading signals based on rigorous analysis. Here are some of the main benefits it offers:

- Improves Timing – By isolating the trend and identifying reversals, the indicator can potentially improve trade entry and exit timing.

- Enhances Discretion – Traders maintain full discretion over final trading decisions. The indicator provides additional context, not automated entries.

- Optimizes Stop Losses – Stop losses are set at logical levels based on recent price action, helping manage risk.

- Tracks Performance – Ongoing statistics provide traders with transparency into the indicator’s historical performance.

- Saves Time – The indicator performs complex analysis of trends, success rate, targets and stops on the trader’s behalf.

- Easy to Use – Despite its sophistication, the indicator has an intuitive interface. Traders can quickly interpret signals.

- Works Across Markets – The indicator can be applied to forex, stocks, commodities, indices and cryptocurrencies.

Key Features and Settings

The AW Trend Predictor has a range of customizable settings that allow traders to adapt the indicator to their preferences:

Trend Evaluation Window – Controls the lookback period for trend identification. A larger window smooths out shorter-term moves.

Forecast Window – Determines the forward projection for take profit targets. A larger window projects targets further out.

Success Rate Threshold – Sets the minimum success rate required to trigger a new entry signal. Higher thresholds focus on higher-probability trades.

Take Profit Multiplier – Controls the distance of projected take profit targets based on recent volatility. Higher multipliers target larger gains.

Stop Loss Multiplier – Sets the stop loss distance from the entry based on volatility. Higher multipliers allow more room for price fluctuation.

Statistics Module – Provides key metrics like win rate, average gain, average loss and more for longs and shorts.

Signal Alerts – Traders can enable alerts when a new signal is identified, including audio, visual and push notifications.

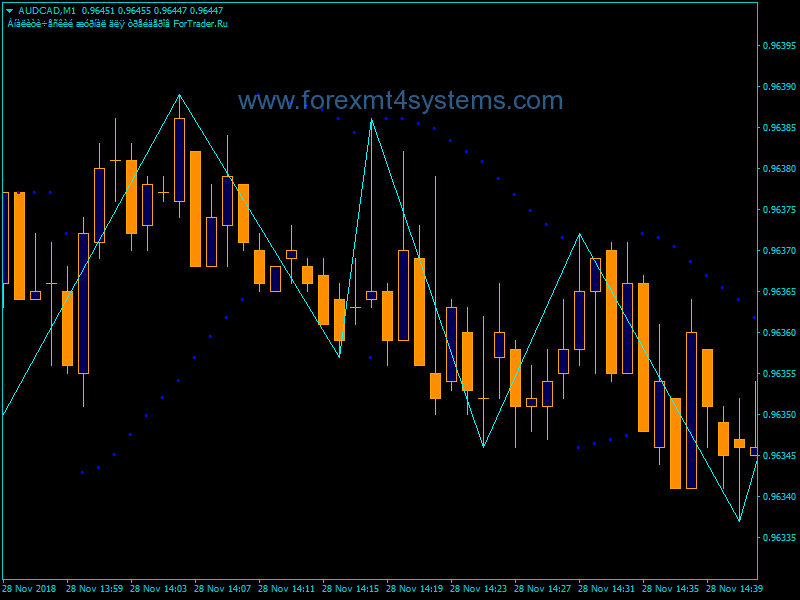

Multiple Timeframes – The indicator can be applied to any timeframe from 1 minute all the way up to the monthly chart.

Using the AW Trend Predictor Effectively

While the AW Trend Predictor can be a valuable addition to a trading system, it is not a magic bullet. Here are some tips for using it effectively:

- Combine with Other Analysis – Use the indicator in conjunction with overall technical and fundamental analysis. Don’t rely on it exclusively.

- Start on Higher Timeframes – Begin analyzing signals on larger timeframes like the 4H or daily charts before moving down to smaller timeframes for entries.

- Be Selective – Focus only on signals that meet your minimum success rate, profit potential and risk tolerance thresholds.

- Consider Market Conditions – Factor in the overall market environment when evaluating signals. Some conditions favor trending strategies more than others.

- Use Stops – While the indicator identifies logical stop levels, traders should still determine appropriate stop sizes based on their risk appetite.

- Monitor Performance – Continuously track performance metrics and look for deterioration. Be willing to stop using signals that underperform.

- Manually Backtest – Backtest the indicator on historical data in a demo account to analyze performance before risking real capital.

Pros and Cons of the AW Trend Predictor

Pros

- Provides high-probability trade signals in trending markets

- Optimizes entry, exit and stop loss positioning

- In-depth statistics module improves transparency

- Easy to set up and interpret

- Works across all major asset classes

Cons

- No guarantee signals will play out as projected

- Requires an existing trend, non-trending markets can cause whipsaws

- Potential for over-optimization and curve-fitting

- No concrete rules for integrating signals into overall system

Verdict: A Potentially Valuable Tool with Limitations

The AW Trend Predictor is an elegantly designed indicator that simplifies the process of identifying high-probability trend trades. The statistics module provides helpful ongoing performance tracking.

However, as with any indicator, results will vary across different time periods and asset classes. Traders should incorporate signals as part of a robust, well-tested system with clear risk management rules and not rely solely on the indicator.

While not a magic bullet, the AW Trend Predictor can serve as a valuable addition to a trader’s toolbox in the right market environment. It excels when used selectively and in conjunction with other confluent factors. Just always maintain trading discipline and use stops when integrating signals into your overall approach.