Forex Trend Signal Arrows Indicator: A Powerful Trading Tool

Forex Trend Signal Arrows Indicator are technical analysis tools used by traders to identify potential buying and selling opportunities in the currency markets. These indicators generate arrow signals pointing up or down when a new trend may be emerging, allowing traders to capitalize on emerging trends early. In this comprehensive guide, we will explore what forex trend signal arrows indicators are, how they work, their key benefits, and how traders can effectively use them as part of their trading strategy.

Download Free Forex Trend Signal Arrows Indicator

What is the Forex Trend Signal Arrows Indicator?

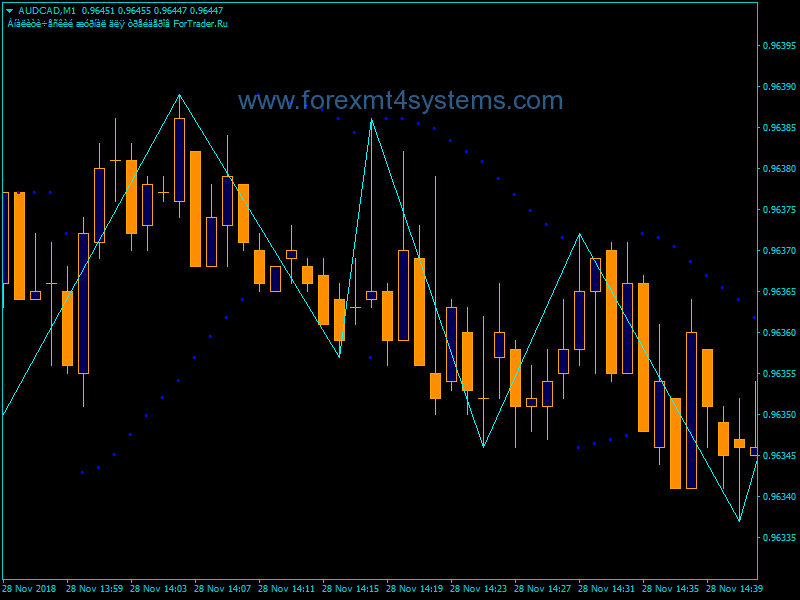

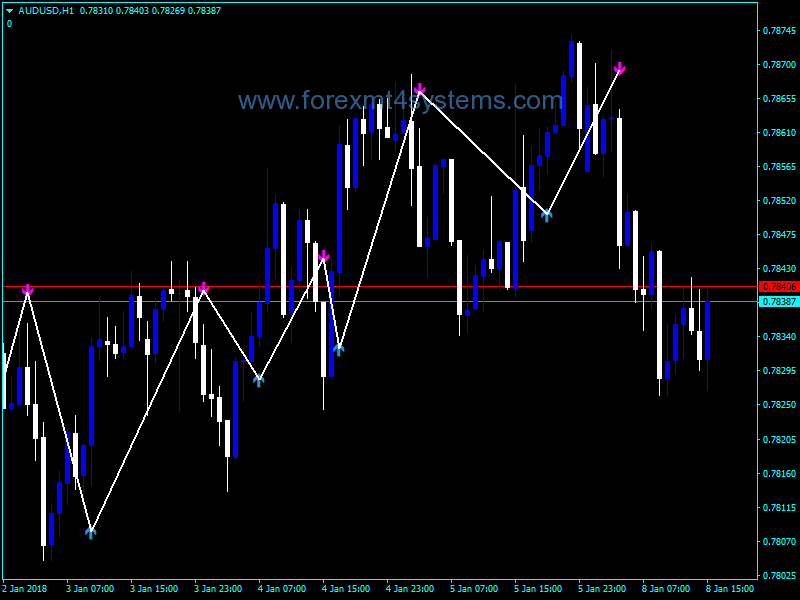

The forex trend signal arrows indicator for MT4 is a technical analysis tool that displays arrows on a price chart when a new trend may be emerging. It analyzes price action and other technical indicators to determine when a trend reversal or continuation is likely occurring.

Up arrows indicate a potential uptrend or bullish price move, while down arrows suggest a possible downtrend or bearish move. The arrows act as alerts, prompting traders to further analyze the price action and potentially enter a trade in alignment with the emerging trend.

Some key features of forex trend signal arrows indicators include:

- Directional arrows – The main feature is the plotted arrows pointing up or down when a trend reversal or continuation is detected.

- Customizable settings – Traders can tweak parameters like the indicator calculation method, arrow alert preferences, and appearance.

- Trend identification – Analyzes price action, volatility, and momentum to determine the bias of emerging trends.

- Real-time alerts – Arrows are plotted in real-time, allowing immediate action when signals generate.

- Works on all timeframes – Can be used for short-term scalping or long-term trend following on timeframes ranging from 1 minute to 1 month.

How Does the Forex Trend Signal Arrows Indicator Work?

Forex trend signal arrows indicators utilize a variety of technical analysis techniques to generate timely and accurate trading signals. Here is an overview of how these indicators work:

- Price action analysis – The indicator analyzes the price action, including pivot points, support and resistance levels, candlestick patterns, and chart formations.

- Volatility analysis – It studies volatility in order to gauge trend strength and spot trend reversals that may be approaching.

- Momentum analysis – Indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) are used to identify shifts in market momentum.

- Moving averages – Crossovers between fast and slow moving averages often signal trend reversals. The indicator monitors key moving averages.

- Complex algorithms – Advanced calculations and combinations of technical techniques are used to generate robust arrow signals optimized for profitability.

The indicator continuously performs these analyses in real-time. When the algorithms detect a high probability trading opportunity aligned with an emerging trend, an arrow is plotted on the chart signaling a potential entry point.

The Benefits of Using Forex Trend Signal Arrows Indicators

Forex trend signal arrows indicators can enhance a trader’s ability to identify trends early and pinpoint optimal entries. Here are some of the key benefits these indicators offer:

- Spot emerging trends – Get early notice of new trends, allowing more time to analyze and enter trades.

- Prevent false signals – Complex algorithms filter out false signals, providing accurate trend change alerts.

- Easy visual signals – Arrows clearly indicate market direction, making analysis straightforward.

- Enhance risk management – Entry signals aligned with trends improve profitability and risk mitigation.

- Improve timing – Identify optimal entry points so you enter at the start of trends.

- Boost efficiency – Require less active chart monitoring since alerts notify you of trading signals.

- Versatile usage – Can be combined with other indicators or used alone with any trading system.

- Backtesting – Test the indicator’s historical performance to validate its edge before using it live.

Overall, forex trend signal arrows indicators give traders an edge by providing easy-to-interpret alerts that flag trading opportunities with a higher probability of success.

Using Forex Trend Signal Arrows Indicators Effectively

While forex trend signal arrows indicators offer important trading advantages, they should be used properly in order to maximize their usefulness. Here are some tips for using these indicators effectively:

- Combine with other analysis – Use the arrows in conjunction with price action analysis, other technical indicators, and chart patterns to confirm signals.

- Optimize parameters – Adjust the indicator settings such as calculation method, arrow alerts, and appearance to best fit your trading style.

- Consider risk management – Use appropriate stop losses, position sizing, and risk-reward ratios to manage risk.

- Trade in trend direction – Look for trades aligned with the direction of the overall trend in addition to the arrow signals.

- Focus on high probability setups – Certain chart and indicator patterns make arrow signals more reliable.

- Use multiple timeframes – Zoom in and out to assess trends and arrows on short-term and higher timeframes.

- Consider market conditions – Certain conditions increase the likelihood of false signals, so combine arrows with analysis of volatility, momentum, and other factors.

- Backtest first – Validate the edge of the indicator by backtesting it extensively before using it with real capital.

By combining arrow signals with in-depth market analysis and robust risk management practices, traders can take full advantage of what these helpful indicators offer.

Examples of Popular Forex Trend Signal Arrows Indicators

Many excellent forex trend signal arrows indicators are available to traders. Here are some of the most popular and effective options:

1. Moving Average Crossover Arrows

This indicator plots arrows when fast and slow moving averages cross over. The direction of the arrow signals if bulls or bears are gaining strength. Moving average crossovers effectively identify trend reversals.

2. Trend Continuation Factor Arrows

This advanced indicator identifies high probability continuations of existing trends using complex calculations. Arrows confirm when a trend has strong momentum in its current direction.

3. Dynamic Support and Resistance Arrows

By plotting arrows along dynamically updating support and resistance levels, this indicator identifies optimal entry points aligned with the trend.

4. Ichimoku Cloud Arrows

This indicator signals when price crosses into or out of the Ichimoku cloud, suggesting a trend reversal may be starting.

5. MACD Histogram Arrows

Crossovers of the MACD line and signal line are shown with arrows, providing reliable trend reversal signals from this popular momentum indicator.

6. Chart Pattern Arrows

Certain chart patterns are likely to lead to trend continuations. This type of indicator displays arrows when those high probability patterns form.

These are just a few examples of the many types of helpful forex trend signal arrows indicators available to traders. It’s recommended to try several options to find the ones that best fit your trading style.

The Risks of Relying on Forex Trend Signal Arrows

While forex trend signal arrows offer helpful trading cues, over-reliance on the signals can be risky. Here are some potential downsides to be aware of:

- False signals – No indicator is perfect, so false signals can and do occur. Arrows must be considered in a broader context.

- Late signals – There can be a slight lag between trend reversals and the plotted arrows. Other analysis is needed to supplement the signals.

- Repainting – Some poorly designed arrows repaint, meaning past arrows change position. Repainting arrows lead to unreliable signals.

- No stop loss levels – The arrows don’t indicate stop loss placement, so sound risk management is still essential.

- No exit signals – Additional analysis is required to determine profitable exit points. Arrows only suggest entries.

- Over-optimization – Extensive curve-fitting can degrade arrow accuracy when market conditions change.

To mitigate these risks, traders should use arrows as helpful supplementary indicators, not as standalone trading systems. Utilizing robust risk management techniques and confirming signals with other analysis is key.

Conclusion

Forex trend signal arrows indicators are valuable technical analysis tools that can improve trading outcomes and enhance trend identification. By signaling potential trend reversals and continuations with easy-to-interpret arrows, these indicators enable traders to capitalize on emerging trends early with well-timed entries.

However, arrows should be combined with other forms of market analysis rather than used as the sole trading system. With the right utilization focused on high probability setups and rigorous risk management, forex trend signal arrows can boost trading success and point the way to profitable trend-following strategies.